The never-ending trend of cryptocurrency adoption in the consumer and business sectors

Some History

Let’s go back about three years in time, to February 10, 2014. The BTC price had just reached the 100 USD mark on Bitfinex — a major exchange for the young currency pair. This points out a possible trend in which BTC becomes the future of consumerism and the business sector.

Who wouldn’t like to get their hands on a time machine to go back to those earlier times to buy some bitcoin? Of course, it’s easy to make a decision in retrospect. However, in reality, people are driven by panic and their emotions, often even by fear and inability to act in the unknown.

The famous value investor, Warren Buffett, called Bitcoin a ‘mirage’; obviously forgetting his own, and arguably his most famous, quote.

“Be Fearful When Others Are Greedy and Greedy When Others Are Fearful” — W. Buffett

In its infancy, Bitcoin was mostly the domain of early adopters, tech enthusiasts, and those who used the dark-web market, ‘’Silk-Road,’’ ( which was shut down by the FBI in October 2013).

Those early days were rife with unfavourable circumstances, which threatened to destabilize and kill the currency. Two examples were Bitcoin’s strong association with crime, and the unfortunate closure of Mt. Gox (and no less than fifteen other exchanges), which meant customers lost their funds.

However, despite all the teething troubles, several legitimate services did manage to emerge during this period, such as Blockchain.info and BitPay. What both of these services did, was to allow their customers to pay for their favorite products with bitcoin, thus eliminating both fraud and gateway fees.

Nevertheless, the masses did not hesitate to catch on to the trend, causing the digital asset to rocket along a high-speed rollercoaster, speedily switching between the blue sky and the cold, hard ground. In fact, according to many well-known fund managers and executives; during that period, Bitcoin died no less than 126 times.

Even though Bitcoin’s reputation was disputable mainly because of the fear and uncertainty that innovation brings, Bitcoin and digital currencies, in general, managed to survive. The trends we are noting are very promising and prospects of a bright future that Bitcoin created for itself and other forms of cryptocurrency are very much visible.

The advancements in the transactions accessibility, better regulation, and adaptability of a process to the individuals are just some of the reasons why analysts consider that Bitcoin has a bright future in the currency world.

It’s worth noting that, despite its alleged robustness and agility, the market cap for bitcoin and other tradeable blockchain assets, is still relatively small and does not come anywhere near the NYSE FANG stocks’ cap. Some might say that this last point is exactly why blockchain assets are such a great early investment opportunity.

2016 marked the pivotal point in price-action, regulation, and broad adaptation (wired.com) for BTC.

Here’s how it all changed:

1. Show Me the Hockey-Stick Chart — Favourable Price Action

One of the key reasons why bitcoin and blockchain technology should be meticulously followed is due to their scarcity and value of cryptocurrency and its technology. The price of Bitcoin has increased, over three times, against all major currencies (EUR, USD, JPY, CNY) and similar forms of digital currencies such as Ripple or Ethereum. In fact, bitcoin beat all the major US stocks & indices in 2016 and was a close tie with gold (1 Ounce per bitcoin). Additionally, Bitcoin is not fully and freely available which will make its value grow over the years. Ever since it started to fluctuate but in any case, its value has surpassed all expectations and will continue to do as predictions suggest.

Sources:

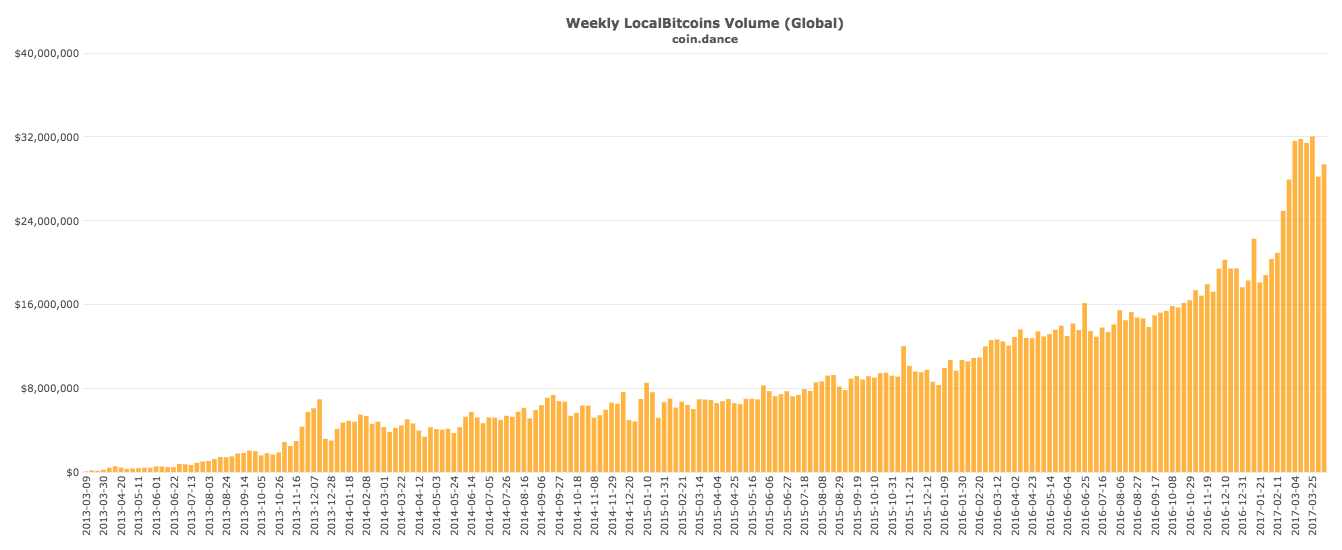

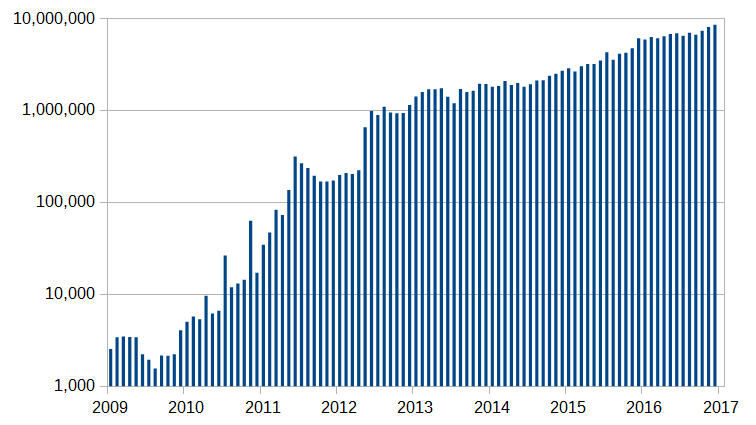

2. Volumes, Volumes, Volumes

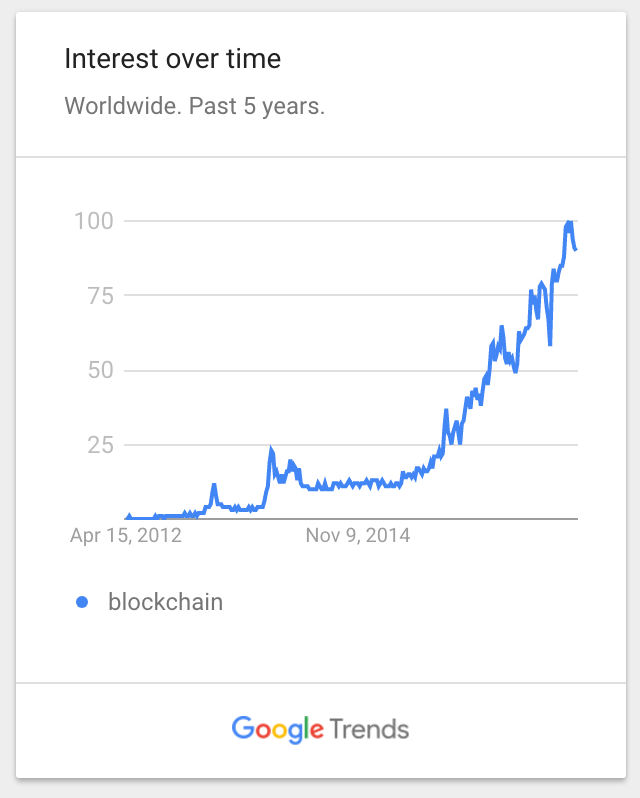

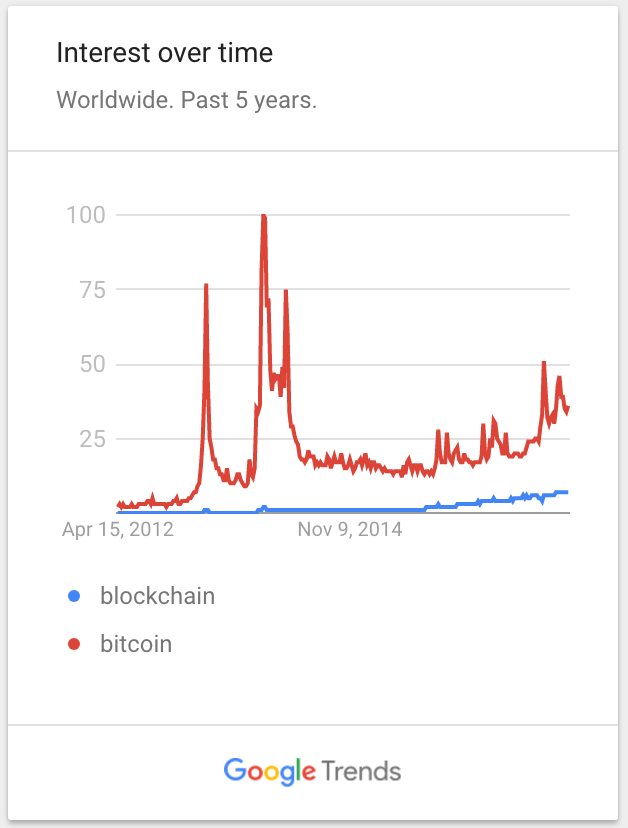

Trading volumes have increased on all major exchanges. This rise is an indication of the growing adoption of Bitcoin, both among individuals and the business sector. This is primarily visible in the increase of Bitcoin use for the bank and commercial transactions of big corporations and tech giants which is followed by the rising interest of individuals in blockchain & Bitcoin in Google searches.

While the blockchain chart might look more appealing, Bitcoin is still the big winner on volumes, perhaps because of its growing popularity among non-technical consumers. This can be very visible in the increase of consumers that value transparency in transactions, as well as fast access to their capital and liquidity pools.

As visible in the analysis, there is an extensive increase in the use of bitcoin for the transaction process and therefore an increase in the influx of customers who value simple, secure transactions with full control. This basically covers all corporations and an increasing number of individuals.

Weekly Localbitcoin.com trade volume. Source: coin.dance

Total bitcoin transactions per month, source: Wikipedia — history of Bitcoin

Blockchain interest 5Y chart. Source: Google Trends

Blockchain vs. Bitcoin 5Y chart. Source: Google Trends

3. Bitcoin, Not the Bad Guy Anymore

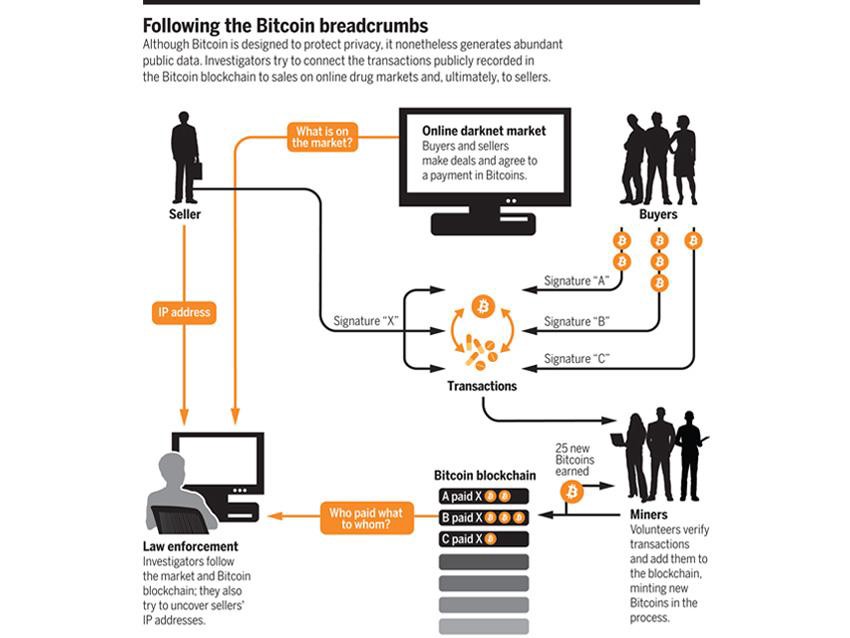

According to recent research, carried out by the Central Bank of Germany, in conjunction with independent researchers, crime is no longer a leading factor in the Bitcoin economy.

Even though in the beginning there was a concern regarding the accessibility of Bitcoin on the dark web, the tracking of transactions and the level of transparency created to make Bitcoin safe for use seem to push this narrative away.

While Bitcoin was never intended to be tracked by governments, the transparency of its blockchain puts it in a more favourable regulatory category than some more obscure currencies, such as z-cash.

In this post, ISS World Training specifies the numerous techniques of tracking down Bitcoin transactions.

In addition, a more detailed explanation of why criminals really cannot hide behind Bitcoin can be found here, in ScienceMag.

Contributing to this, now cryptocurrency creators aspire to become part of the financial media system and seek to regulate transactions, stop tax evasions, protect the customers and increase security making it more appealing to everyday use.

More reads:

Danish Police claims a breakthrough in Bitcoin criminal usage tracking

Silk road clients ‘busted’

The Bitcoin Economy has ‘matured’

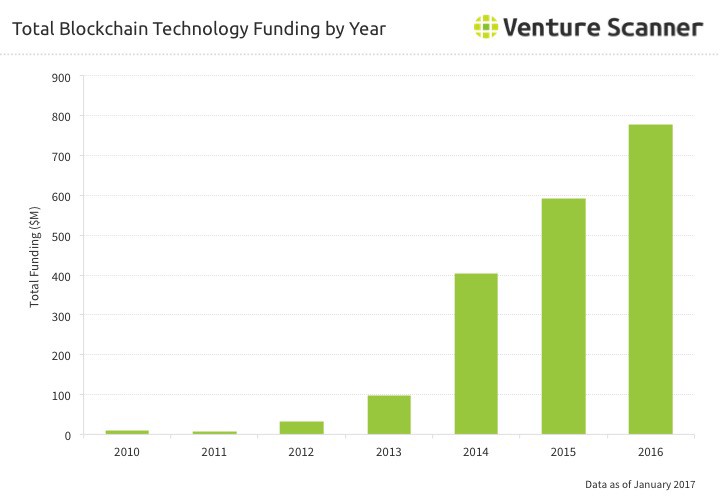

4. Rising VC Interest

According to venturescanner.com, Bitcoin & blockchain, start-up funding grew, to 550 Million USD in 2016, closing the fourth year of consistent growth. This is a fresh trend, waiting for a major breakthrough, and shouldn’t be overlooked.

One of these VC-backed startups, shapeshift.io, is a direct competitor of nexchange.co.uk. Shapeshift was able to raise an additional round of funding (10.4 Million USD according to Business Insider) on top of recently enjoying a significant volume spike.

Yearly Bitcoin & Blockchain investments. Source: venturescanner.com

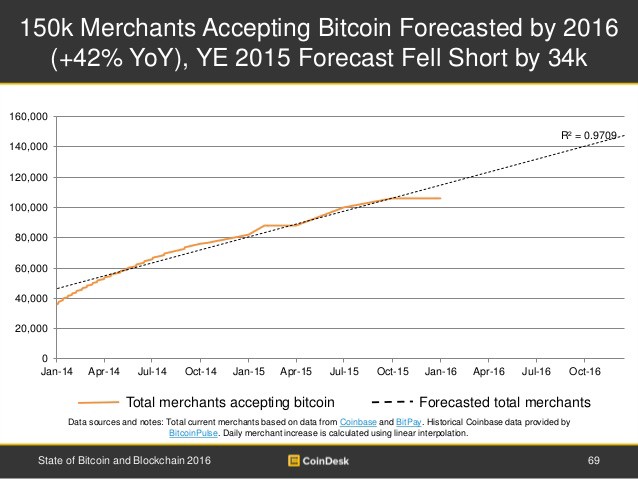

5. Broad Merchant Adoption

The Bitcoin merchant pioneers (Blockchain, Bitpay), that we mentioned earlier, were followed by industry giants, such ass BrainTree Payments(PayPal Inc.), and Stripe.

However, this is not as promising as it may sound. Whereas these companies will readily convert consumer bitcoins to cash, as a merchant service; they will also politely refuse to work directly, as a payment provider, for Bitcoin-oriented businesses, claiming the perceived ‘high-risk’. In so doing; they are eliminating the competition and leaving Bitcoin exchanges and merchants’ business to the smaller players, such as Simplex.com (a bitcoin merchant service that recently raised 7 Million USD in series A).

According to this Slideshare, there are currently more than 150,000 merchants who accept Bitcoin as payment; among them are major companies, such as:

Source: Nexchange FAQ

Earlier this month, Japan certified Bitcoin as an official payment method, and the currency is moving towards gaining full regulation in Russia after being fully legalised there, back in November 2016. Sensibly Russia also applied the existing laws and regulations concerning plain foreign currency to the innovative coin.

Chart source: coindesk.com

6. Increase in Regulation and Government-Acceptance

Recently PBOC (China) stepped into the Chinese Bitcoin scene; which, up until that point, was known for its dominant, and some say fake, volumes.

The People’s Bank of China has, however, prohibited speculative activities, such as leverage, futures options, and the use of ‘fake volumes’. They have also ruled that each Bitcoin trading website must be defined as a ‘website’ rather than an ‘exchange’, which was the term used previously (bitcoin.com). Because of the tightening of AML regulations, all major Chinese exchanges paused withdrawals in non-fiat (crypto) mediums for over a month. Some of those restrictions are still in force today, after having been extended several times; although the effects of the restrictions on Bitcoin price-actions are surprisingly negligible, in the short to mid-term. These control procedures, as unpleasant and unfavourable as they may seem for the markets in the short-term, are in fact part of positive larger growth and indicate a trend towards the legitimation of the cryptocurrency.

However, China was not the first country to impose regulatory limitations on the Bitcoin and Cryptocurrency sphere. Despite there being no USA federal regulations, concerning bitcoin, and in the face of the SEC’s denying the Winklevoss twins ETF, individual regulation does already exists in certain US states, such as New York and Washington.

The UK has taken a more permissive path, claiming that some Bitcoin-related businesses do not require FCA regulation. In other cases, a simpler and more accessible HMRC AML registry regulation can be sufficient to legally operate a crypto business. The UK journal, CryptoCarbon also reached the same conclusion.

In other cases, Bitcoin regulation has been a continuous and gradual process.

Early on, Russia proposed a full-scale Bitcoin Ban. This plan was later put on hold and eventually, a legalisation (and abuse penalty) plan was drawn up. Finally, several days ago, Bitcoin was officially declared fully legal and regulations began to be formulated.

In conclusion, it seems that we are on the verge of a blockchain era; an age where election fraud will be impossible and the poorer populations of the world will have access to comprehensive financial services.

So keep following, and don’t fall behind!

The writer is the founder of n.exchange, an innovative cryptocurrency exchange that aims to simplify the cryptocurrency conversion process for businesses and consumers.

We are constantly looking for affiliates and business partners,

Feel free to drop us a line!

More info can be found on the affiliate section of our site.